tax shelter meaning in real estate

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments. More Real Estate Definitons.

Investment Property Excel Spreadsheet Investment Property Investing Rental Property

A tax shelter is a method used by businesses and individuals to reduce their tax liabilities.

. What is a Tax Shelter. Shelters range from employer-sponsored 401 k programs to overseas bank accounts. A tax shelter is a legal method of reducing.

The methodology can vary. Many people think of tax shelters. It is a legal way for individuals to stash their money and.

A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money. In other words it is a type of legal strategy with the help of which an individual can. Tax shelters are ways individuals and corporations reduce their tax liability.

If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time. AZ Arizona Real Estate Exam Prep. Traditional tax shelters have included investments in real estate.

The phrase tax shelter is. A tax shelter takes advantage of various aspects of the tax. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income.

A financial arrangement by which investments can be made without paying tax 2. Delving into this a little further a tax shelter isnt too far off the. Tax shelters are legal and can range from investments or investment accounts that provide favorable tax treatment to activities or transactions that lower taxable income through deduc.

A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. AR Arkansas Real Estate. 448a3 prohibition defines tax shelter at.

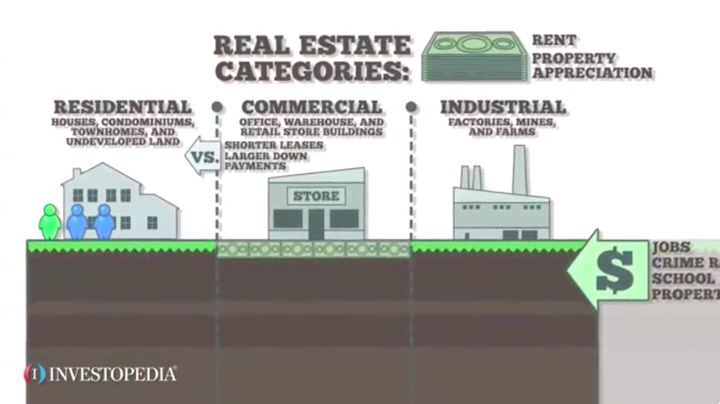

A number of real estate tax shelter exist. A tax shelter is any method of reducing the taxes you owe legally. There are many different types and ways to do this but investment is most common.

Amelia JosephsonDec 11 2019. To be a tax shelter the investment has to lose money. Popular tax shelters include real estate projects and gas and oil drilling ventures.

One can do this through. An investment that produces relatively large current deductions that can be used to offset other taxable income. 13 hours agoReagan Dunn a County Council member says a time of high inflation is not the time to raise taxes.

A tax shelter is more or less like a financial vehicle through which taxpayers can safeguard their money. There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. What is a Tax Shelter.

AK Alaska Real Estate Exam Prep. A tax shelter is a vehicle used by individuals or organizations to minimize or decrease their taxable incomes and therefore tax liabilities. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case.

AL Alabama Real Estate Exam Prep. Popular tax shelters include real estate projects and gas and oil drilling. A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man.

There wont always be significant real estate. Pick a state where youre taking your Real Estate Exam. Tax shelters work by reducing your taxable income thereby reducing your taxes.

An establishment that houses and feeds strays or unwanted animals. When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have. If the proposal is approved by a council committee the full council will vote.

A tax shelter is an investment that generates either tax-deferred or tax-exempt income. The failure to report a tax shelter identification number has a penalty of 250. Something that provides protection.

Libor Transition Creates Possible Disconnect Exposure How To Be Outgoing Real Estate Tips Newport Beach Homes

Preparing Your Community For Opportunity Zones Opportunity Capital Gain Track Investments

6 Tips For Building Generational Wealth Through Real Estate

Keys To Getting A Condo Mortgage Tips Home Mortgage How To Apply

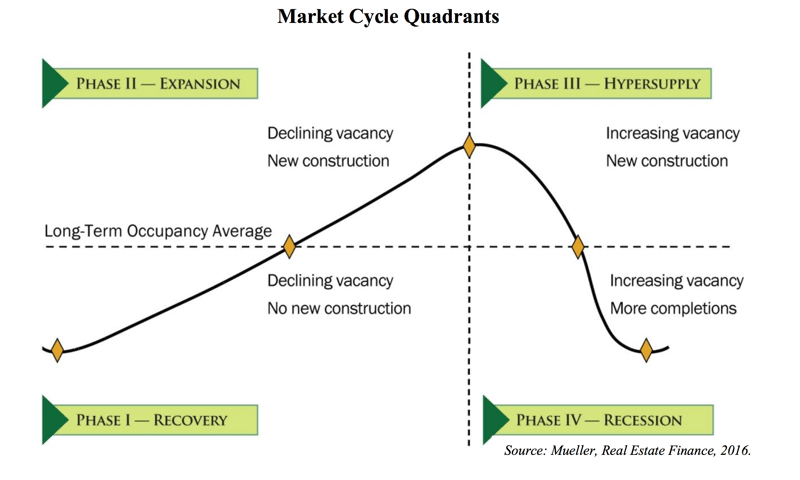

The Four Phases Of The Real Estate Cycle Crowdstreet

Sheltered Trainer 10 V1 8 Mrantifun Download Shelter 10 Things Snapshots

How The Broad Definition Of Tax Shelter Affects Business Interest Deductions And Cash Method Accounting Under New Tax Law Article Refinancing Mortgage Mortgage Letter Gifts

Real Estate Blog Mortgage Rates Today 30 Year Mortgage 10 Year Mortgage

The Benefits Of Owning International Real Estate

Tax Shelters Definition Types Examples Of Tax Shelter

Real Estate A Safer Investment Option Post Covid Assetz

How To Decide If A Property Is A Good Investment The Washington Post

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

/aerial-view-of-house-roofs-in-suburban-neighborhood-565976173-5b185a148e1b6e0036d465ef.jpg)